This page provides fundamental information about our electric vehicles (EVs), including details of the many Government incentives and tax breaks which make owning and using an electric vehicle financially massively more attractive than Internal Combustion Engine (ICE) cars.

The Monthly Updates page includes detailed information on the ‘cost of electric motoring’ we are experiencing using our EVs, compared to fuelling conventional ICE cars.

In late-November 2019, we added a very exciting new electrified mode of transport to our EVs, so currently our ‘fleet’ comprises the following three vehicles, which are described in more detail in the following sections of this page.

| Vehicle | Seating capacity | kWh Battery | Range on a single charge | Range recharged using fastest possible charger | Range recharged in 10 hours overnight at home |

|---|---|---|---|---|---|

| Riese & Müller Supercharger 2 eBike | 1 | 1 | 70 – 100 | 35 miles in 30 mins | 100 miles |

| Tesla Model X P100D Ludicrous | 7 | 100 | 265 – 275 | 67 miles in 10 mins 190 miles in 30 mins | 180 miles |

| Nissan Leaf Tekna | 5 | 30 | 100 -110 | 21 miles in 10 mins 65 miles in 30 mins | 110 miles |

Riese & Müller Supercharger 2 eBike

Alan just splashed out on some premium German engineering at its best, a top end Riese and Müller eBike, which is pictured below with a visiting Tesla Model S and in front of our Tesla Powerwall.

We’ll be posting a detailed review of life the Supercharger 2 when Alan’s put a few miles on it. For now, the key specs are as set out below.

- 1 kWh battery

- Range 100 miles

- Fully integrated Bosch eBike sub-systems including:

- 2 x 500Wh batteries, concealed in crossbar and mainframe;

- 4th Generation Performance Line CX motor;

- KIOX cockpit, magnetically attached to handlebars, which immobilises the eDrive system when removed and is synced to Bosch eBike app;

- Battery management and drive control system, concealed in seat post;

- Bosch eBike app, giving in-depth performance and energy consumption data for both the electric drive and for the rider.

- Rohloff E-14 internal gear hub, replacing conventional gears, with electronic gear shifting.

- Gates carbon belt drive, replacing conventional chain.

- A ‘Thudbuster’ seat post shock absorber (literally to reduce pains in the arse).

- And a very clever mounting for a water bottle…!

Alan purchased his Riese & Müller Wunderrad from the leading specialist in the North East of England, The eBike Store in Durham. Simon and his team stock a wide range of eBikes and are exceptionally knowledgeable in their specification, supply and service.

Tesla Model X

Since February 2017, we have owned a Tesla Model X P100D, equipped with the high performance ‘Ludicrous’ mode. The Model X is a seven seater SUV, weighing 2.4 tonnes. We are using this section on the Model X to present wider information on the financial incentives and tax advantages of EVs.

The fun bit (drag racing).

Model X versions with the Ludicrous option will slaughter most supercars (and plenty of motorbikes!) in a 0-60 mph drag race but will happily take your granny to bingo. The internet abounds with amusing videos of such drag races: a quick Google search will deliver many hours of entertaining diversion as dinosaur-fuelled supercars are humiliated.

A whilst on the subject of taking granny out for a spin, it can be particularly amusing to pull up at a red light alongside a common or garden supercar when you’ve got an actual granny in the back, maybe on the way back from her weekly shop. Borrow the granny if you don’t happen to have one handy, it adds singificant comedy value. As for the opposition, any old Ferrari will do, if super-exotics are a bit thin on the ground in your neck of the woods.

Gently suggest that granny might wish to rest the back of her head on the headrest on the orange light. Then floor the pedal on green. And then use the helpful HiDef rear view camera on the giant touchpad to enjoy the look on Mr Maranello’s face whilst:

- You, granny, and up to five further occupants of the Model X disappear into the distance, whilst his highly impractical two seater sets fire to a lot of gas, makes a lot of noise, wastes lots of energy spinning metal bits in the engine and belches lots of poison into the atmosphere.

- His shopping falls off the passenger seat. It’s usually there because he’s got less luggage space in his entire car than you have in the ‘frunk’ under the bonnet, in addition to the very capacious hatchback boot of the Model X. Mr Prancing Horse’s car has to accommodate a large lump of OldTech doing the fire/ noise/ spinning/ belching thing; the Model X interior is, by contrast, essentially all usable space.

- You exercise restraint at precisely the point you reach the speed limit, whilst pure frustration powers him past with his foot still firmly on the fire/noise/belch pedal, onward into the loving embrace of your friendly neighbourhood radar trap.

The sensible bit (saving money).

Amusing as it may be to put supercars to the sword at traffic lights (believe me, it is very amusing – the more expensive the OldTech car left in your wake, the greater the comedy value, you’ll find), the real value of electric cars lies in the massive savings in both emissions and cash they enable you to make.

In our case, with all EV charging at home sourced from solar and/or 100% renewable off-peak grid electricity, we’ve completely wiped out the pollution bit.

The emissions reduction is brilliant, but it’s the money that’s the real clincher.

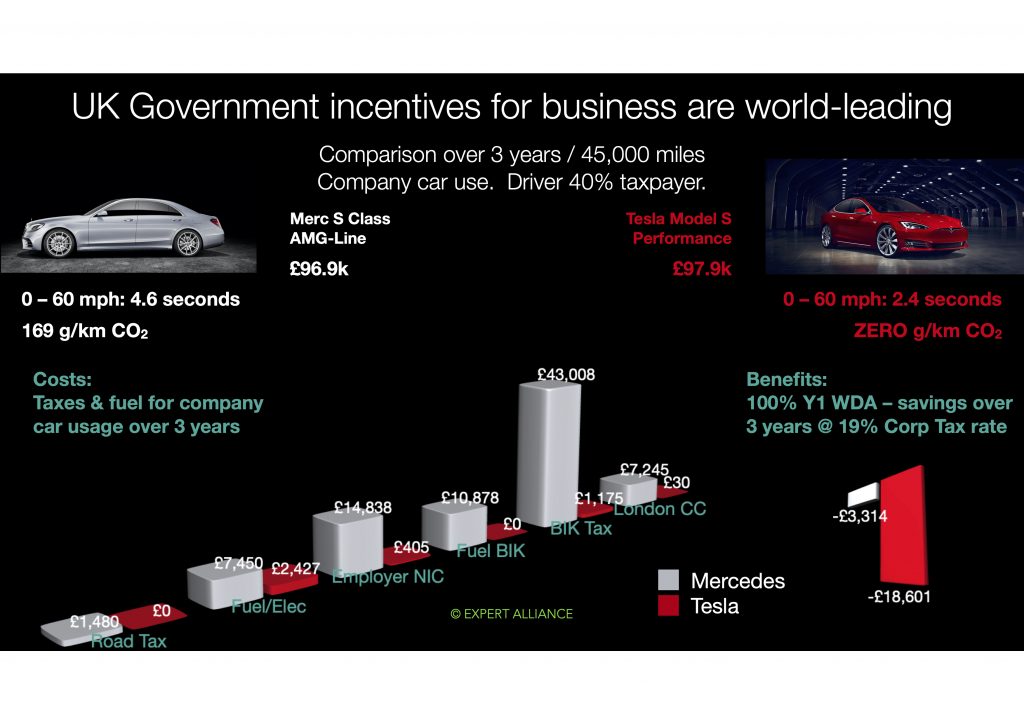

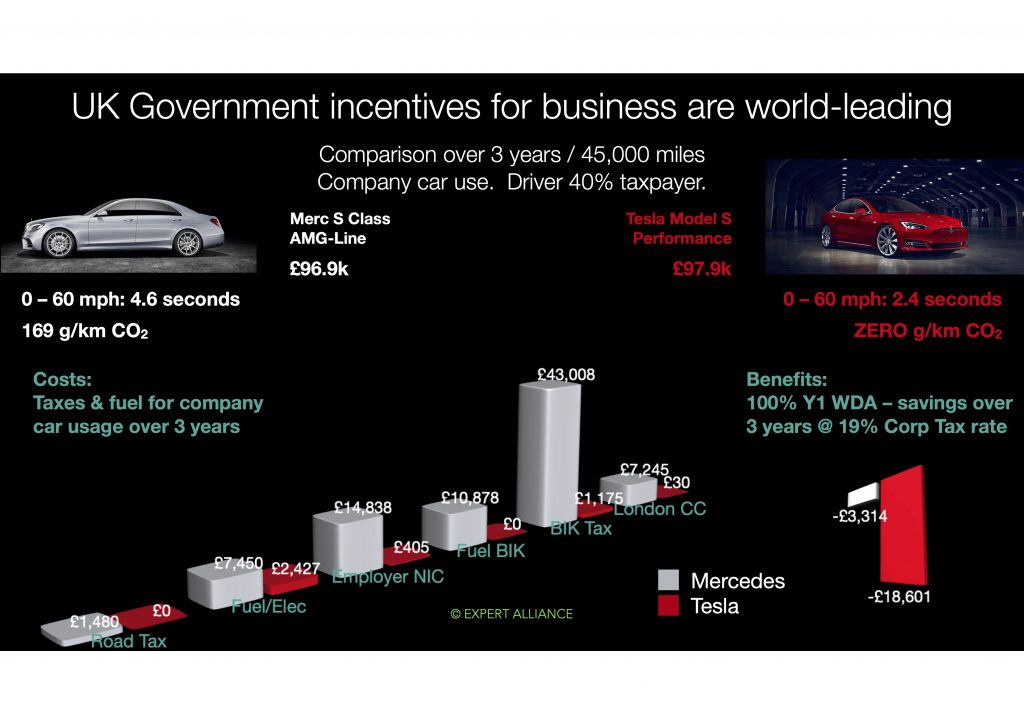

The infographics below show a detailed breakdown of the tax advantages and other financial incentives available to businesses and company car drivers for using a high end Tesla Model S electric car versus a comparably priced ICE car over 45,000 miles and three tax years, starting 06 April 2020. Detailed analysis, and further examples using mid-market and mass market cars follow later in this section.

Disclaimer: This section of the website contains information on car finance and taxation. Its purpose is to convey general information that may be applicable when considering certain financial transactions, in certain circumstances. This information is presented solely for educational purposes in order to produce an indicative illustration of the costs and benefits of EV ownership.

This website does not convey, and is not intended to convey, financial advice relevant to any specific person or business, nor is it intended as a solicitation to enter into any financial agreement of any nature whatsoever. Car finance and the related fields of personal and business taxation are complex. Readers should seek independent financial advice before entering into any financial obligation. Readers should not take any actions as a result of the financial information contained in this website, nor should they place any reliance upon such information.

Any or all of the tax and other EV incentives described in this website may change or be withdrawn at any time. Car specification and pricing may change at any time. Not all incentives may be combinable by all users, depending on their specific tax position and vehicle usage patterns. The authors and publishers have no control over when, if, and by how much, these materially relevant factors directly impacting the value propositions described apply, may change, or be withdrawn.

The authors and publishers of this website specifically disclaim any and all liability arising from any actions taken, or any agreements entered into, by any third party acting upon, or placing reliance upon, the financial information contained herein. Readers should seek independent expert advice.

The authors’ and publishers’ disclaimer shall apply in full to any information extracted from this website by any means which is then republished in any form.

THE GRAPHICS PUBLISHED BELOW MAY BE REUSED AND REPUBLISHED FOR INFORMATIONAL PURPOSES ONLY PROVIDED THEY ARE WHOLLY UNALTERED AND INCLUDE THE STATEMENT OF EXPERT ALLIANCE COPYRIGHT. ANY PERSON REUSING ANY OR ALL OF THESE GRAPHICS MUST INCLUDE THE DISCLAIMER STATED ABOVE IN FULL IN ANY DOCUMENT, WEBSITE, PRESENTATION OR ANY OTHER COMMUNICATION IN WHICH THE GRAPHIC(S) APPEAR.

Multiple financial advantages: summary

This graphic shows the multiple financial advantages of EV ownership in the UK, using the example of the £97.7k Tesla versus the £96.8k Mercedes. It presents the advantages over a typical three year term, commencing on 06 April 2020, after the start of Tax Year. Both cars are modelled to cover a typical business mileage of 15,000 miles a year, making 45,000 miles in total. For the BIK savings, a company car driver paying the higher (40%) rate of tax on the top-slice of her/his remuneration package is modelled.

The basic message here should be pretty obvious:

- If you are a high-earning employee paying 40% personal tax, you should refuse to accept any non-electric company car from you employer, unless you actually want to be £43,000 worse off after tax over the typical three year term of a company car deal (on this example), more if you, not the employer, pay for fuel and road tax.

- If you are an employer, and you want to give your senior staff a substantial ‘direct into the pocket’ pay rise, which will cost your business absolutely nothing, because it’s HM Treasury that’s taking the pain for once, then you should insist that their next company car must be electric.

As noted in the disclaimer, this analysis applies only in the UK, where a variety of tax breaks and other Government incentives are available to support the uptake and use of EVs, which can make owning and operating a top-of-the-range Tesla cheaper after tax than a boring mid-range OldTech saloon. Other countries offer different incentive regimes, which will deliver a different mix of benefits.

EV tax breaks, incentives and operational savings

The UK currently has an extremely generous incentive regime to encourage businesses and company car drivers users to switch from ICE vehicles to EVs. It’s not yet up there with Norway’s punitive-VAT-on-petrol/diesel approach (leading to 61% of all car sales being fully electric in September 2020), but, frankly, the UK has no alternative to a pretty radical programme in order to wean users off the ICE habit.

It is already UK Government policy for conventionally-fuelled cars to be banned from sale by 2035. Accelerating this deadline, the 2019 General Election saw a positive competition between the parties on policies responding to the Climate Emergency. A very likely outcome, when coupled with the Tesla-catalysed transformation of the global automotive industry from ICE fuel to electrification, is that Britain’s roads will be all-electric well before 2035 – barring enthusiasts’ cars, museum pieces, and a very few specialist vehicles which require conventional fuel for technical reasons (e.g Fire Brigade pumps, which must be able to operate when batteries are depleted and no grid power is available).

In the context of all the subsidies available, it really makes financial sense to drive an electric car, as we explain below. Forget hybrids and plug-in hybrids (PHEVs); the tax regime targets the real incentives on 100% electric vehicles.

In July 2019, following consultation, HM Treasury announced their intent to strongly incentivise 100% battery electric vehicles (BEVs). In essence, the net effect of the changes which came into effect in April 2020 made it ‘just plain stupid’ for an employee to drive a non-electric company car.

Benefit in Kind tax break on EVs for company car drivers

For many UK drivers, the biggest financial benefit will be the favourable treatment of pure electric cars under the Benefit-in-Kind (BiK) taxation applied to company cars. In summary, BiK works by taxing employees on the benefit they receive if their employer provides them with a company car as part of their overall remuneration package.

The BiK rate is set as a percentage of “P11D Value” of the car – basically the sticker price, including accessories VAT and delivery. BiK works by taxing less polluting cars at lower rates, whilst higher polluting cars are taxed punitively. The BiK rate is then multiplied by the employee’s personal tax rate (e.g. 20%, 40%). Basically, the greener the car the employee drives, the less of her/his headline pay is taken in tax.

The main point to note is that, from April 2020, the BiK rate on 100% electric cars will be 0%, reflecting their emissions of 0 g/km. That rate will rise to just 1% in April 2021 and 2% in April 2022. However, the most polluting cars – models which emit more than 165 g/km – will remain taxed at 37%.

A further BIK tax break is offered on fuel. If an employer pays an employees fuel costs, this is heavily taxed on a formula basis. However zero tax is applied if the employer provides electricity to ‘fuel’ an EV. Electricity is not treated as a fuel for tax purposes.

Employers National Insurance Contribution Savings

Additionally to the massive tax benefits to the employee, the employer providing the benefit of the company car will pay massively lower Class 1A Employers National Insurance Contributions (NIC) on the benefit provided. NIC liaibility is worked on the formula P11D Value x BiK Rate x 13.8%. Therefore:

- A total of £405 Employers NIC is payable over the three years for the Tesla.

- A total of £14,838 Employers NIC is payable over the three years for the Mercedes.

- The employer would save £14,433 NICs by providing the employee with an EV rather than a petrol company car, using our Tesla versus Mercedes example.

London Congestion Charge Savings

Ultra-low emissions vehicles (basically all 100% electric EVs and some of the better PHEVs) are currently exempt from the London Congestion Charge, under the Cleaner Vehicle Exemption scheme. There is a £10 annual cost to apply for and renew the exemption. Note: only 100% electric vehicles will be exempt from the charge from 25th October 2021. The exemption for PHEVs will be withdrawn on that date.

Using our example, the Tesla driver would pay only £10 to access the London Congestion Charge Zone for a year. Assuming the Mercedes driver used her/his car to commute to work in the Zone 5 days a week for 46 weeks a year (allowing for holidays etc.), this would cost her/him £2,645 a year at the full daily rate of £11.50/day, or £2,415 at the discounted £10.50/day rate available for cars enrolled in Transport for London’s auto-payment scheme.

Over the three years of our example:

- £30 London Congestion Charge is payable by the Tesla driver.

- £7,245 London Congestion Charge is payable by the Mercedes driver at the discounted rate.

- £7,935 London Congestion Charge is payable by the Mercedes driver at the normal rate.

Summary of financial benefits

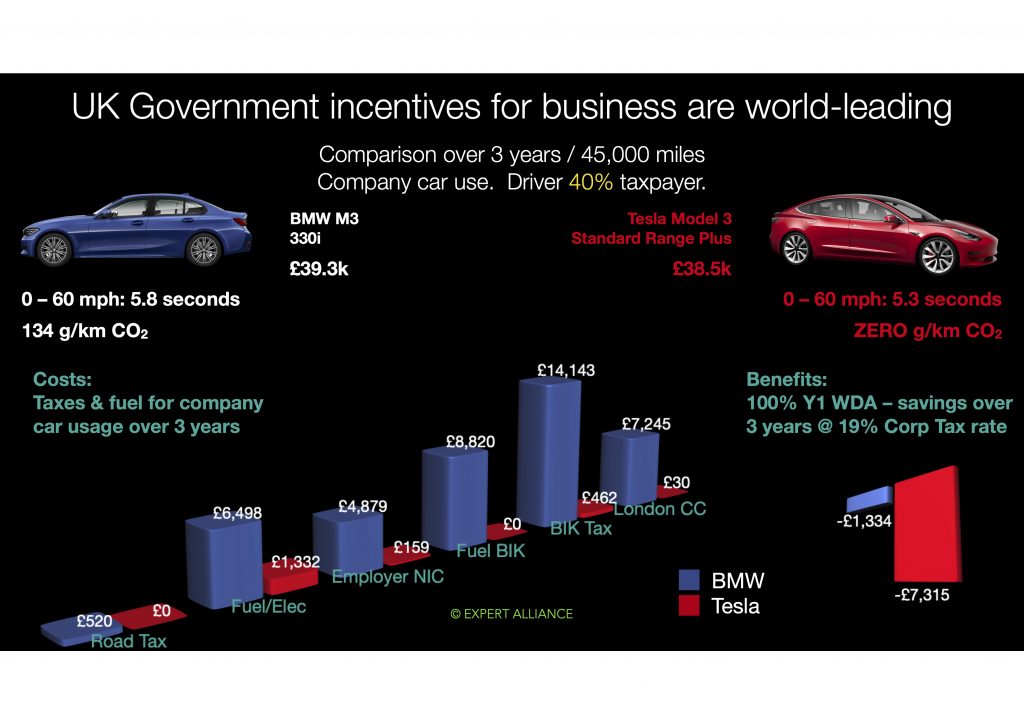

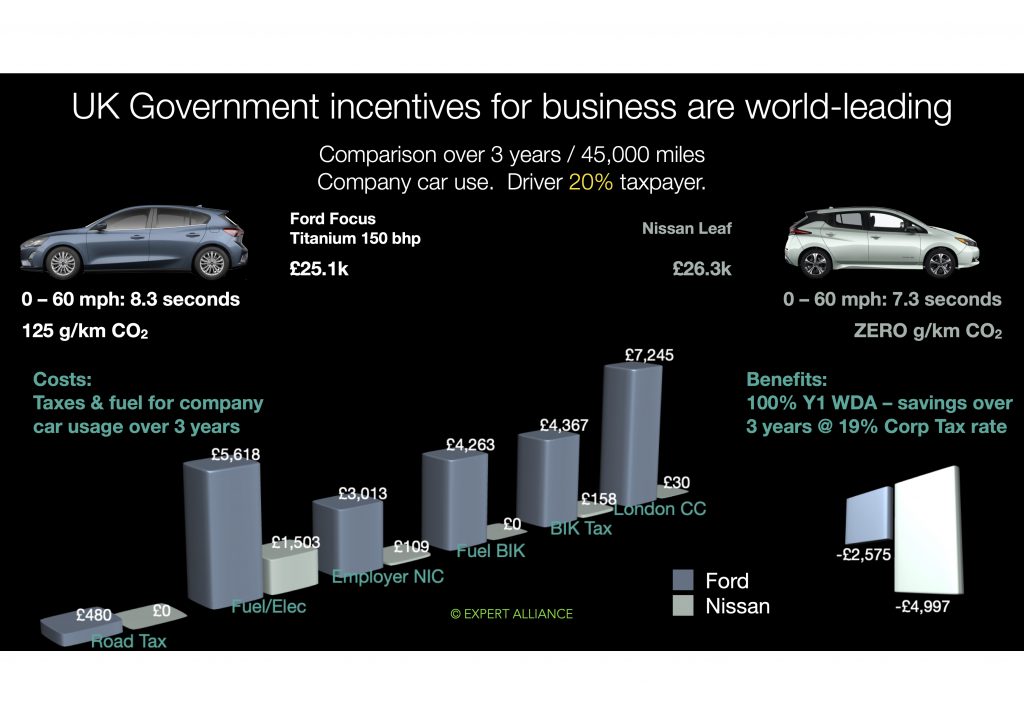

The three infographics below present an overview of the total financial benefits that can be achieved by businesses and company car drivers using upmarket, mid-market and mass market EVs versus ICE OldTech competitors. As the graphics make clear, not only is the driver / personal taxpayer many thousands of pounds better off, so is the employer / business taxpayer. For the upmarket comparisons, a 40% company car driving taxpayer is assumed; for the mass market comparison a 20% taxpayer is modelled.

Charge Point Installation Grants & Related Incentives

Whilst it is possible to charge any EV using a standard 3-pin plug, it is very slow. So installing a dedicated EV chargepoint is advisable. The Government’s Office for Low Emissions Vehicles (OLEV) offers a variety of grant towards the cost of installing dedicated EV chargers, both at home and at workplace premises. Details change frequently, so it’s worth checking the latest state of play here.

In a further advantage for businesses installing workplace chargepoints, any costs not covered by OLEV are eligible for 100% Writing Down Allowance in the tax year the installation was carried out, thus reducing taxable profits by whatever proportion of the WDA amount was paid by the business itself.

And a final advantage is that HM Treasury have decided that electricity provided to employees through workplace chargepoints does not count as a “benefit” and is therefore exempt from both employee BiK taxation and employers NICs. This parallels the very favourable BiK treatment of EVs themselves.

100% Writing Down Allowance on EVs bought by businesses

Another powerful Government incentive comes in the form of 100% Writing Down Allowance (WDA). In short, this allows a business which purchases (or hire purchases) an EV for business use, to set 100% of the cost of that EV against the company’s income in the tax year during which the purchase was made. Loading 100% of the EV on to the cost side of the business in a single year obviously reduces profits and, by extension, the tax the company has to pay on those profits.

The 100% tax offset, compares to only 6% annual depreciation allowable for conventional fuel ICE cars with emissions above 130 g/km. So, using our Tesla versus Mercedes example over three years, the following would apply in the case of, say, a very small specialist professional services practice. For the purposes of comparison, we model the SME company in question with an Annual Income of £500,000, Annual Expenditure of £400,000 and a resulting Annual Profit of £100,000 a year, and paying tax on profits at an effective rate of 24%.

| Item | Tesla | Tax | Mercedes | Tax |

|---|---|---|---|---|

| Sticker price of car | £97,890 | £96,865 | ||

| WDA used in Y1 | £97,890 | £5,812 | ||

| Taxable Profit in Y1 | £2,110 | £506 | £94,188 | £22,605 |

| WDA used in Y2 | £0 | £5,812 | ||

| Taxable Profit in Y2 | £100,000 | £24,000 | £94,188 | £22,605 |

| WDA used in Y3 | £0 | £5,812 | ||

| Taxable Profit in Y3 | £100,000 | £24,000 | £94,188 | £22,605 |

| Total tax paid on (3 x £100k) £300k profits over 3 years | £48,506 | £67,815 |

We have worked the example on a very small business. The economics, of course, scale up to much larger businesses purchasing multiple EVs to create or renew a fleet.

In common with all cars purchased under the UK tax regime, a businesses buying any vehicle which is used solely for business purposes, and is strictly not available for private use, is also able to claim the VAT back

Nissan Leaf

Our Nissan Leaf is now five years old. It works exactly the same as the day we took delivery. In short, it is a very reliable mid-sized car, with its 30 kWh battery and about 120 mile range ideally suited for daily local motoring. From about late-March to mid-October, we ‘fuel’ the Leaf 100% with our ‘home brew’ solar energy. During this period, we pay precisely £0 for local pottering about; which is typically around 500 miles a month.

Nobody would claim that the Nissan Leaf is an exciting car. Indeed, some would say it looks better when covered in snow, hiding those ‘jelly bean’ looks. But the Leaf does have one very nice trick up its sleeve: it is capable of bidirectional charging. This enables both Vehicle to Grid (V2G) and Vehicle to Home (V2H) use.

In essence, V2H and V2G mean that, when you don’t need it for actual driving, the car’s battery stores solar-generated or cheap off-peak grid energy, which you can use at a later time, to power the home during peak hours, or to take the strain off the grid when peak demand stresses the system. Using the Leaf to ‘time shift’ free/cheap electricity in this way, could will result in large cost savings. Its bidirectional capability means the Leaf has a second fundamental economic value, in addition to its usefulness as a car which happens to be dirt cheap to run. It’s basically a domestic storage battery, which just happens to have a car attached.

With the increasing pace of EV adoption putting strain on electricity distribution networks around the world, Nissan’s decision to equip the world’s first widely sold EV for V2G and V2H operation looks like a great piece of foresight. This was almost a decade ahead of cars coming to market in the early 2020s which now also have this capability.

The only problem is that you need an equally bidirectional chargepoint to use the car’s V2G/V2H functionality. Such chargers are not yet widespread. If we are fortunate enough to be selected, we intend to use our Leaf to participate in the world’s first national scale pilot programme for V2H/V2G, which starts in late-2022. If we are chosen to participate, we’ll keep readers up to date on the benefits and savings we’re seeing on the Updates page.

PS: like all electric cars, the Leaf has a nifty trick for dealing with snow and ice. Simply set it to warm up to a nice cosy temperature at your planned time of departure. Not only will it turn the heater on, thereby deicing all the windows and making the cabin nice and toasty for when you drive off, it will also draw electricity it uses for this purpose from the chargepoint (if it’s plugged in of course). This avoids wasting energy from the car’s battery in cold conditions. It’s good discipline to use this ‘preconditioning’ function in any EV: it extends actual driving range by reducing the battery energy required to warm the car. In some EVs (including our Tesla), the preconditioning function will also adjust the battery to its optimum operating temperature, again maximising range as well as comfort.